benefit in kind lhdn

This benefit is provided for the employees by these employers. After all tax exemptions for these entities should be filed through the EA form and this is possible to generate in an HR software like Talenox absolutely free-of-charge.

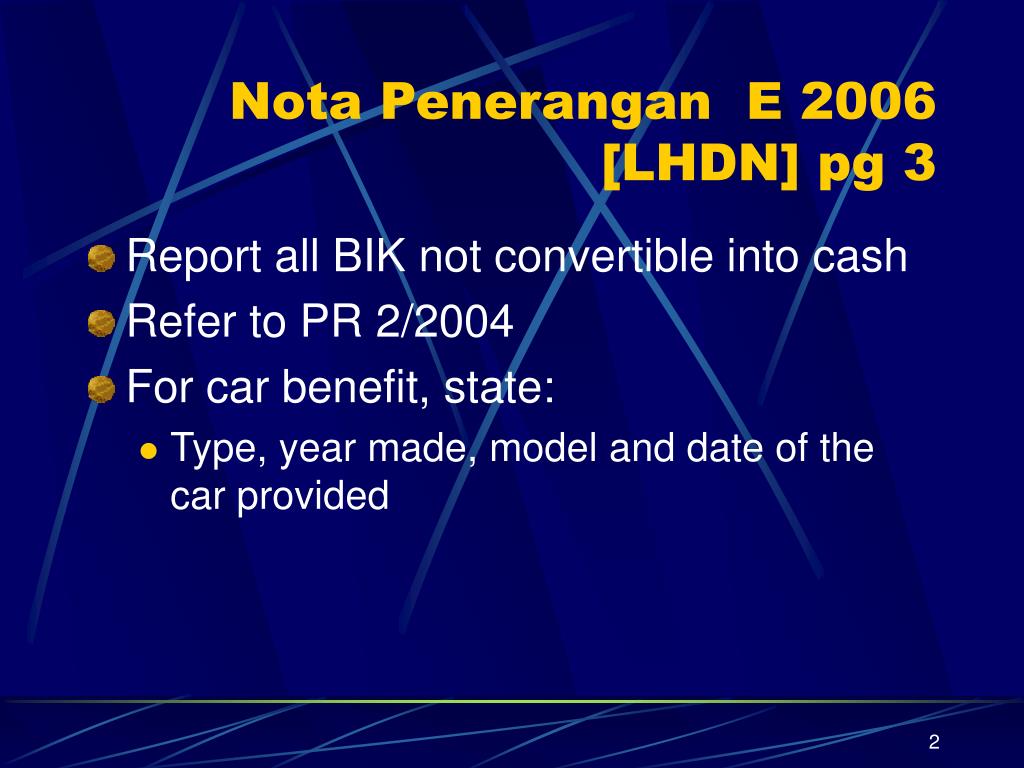

Ppt Form Ea Powerpoint Presentation Free Download Id 3261816

If you disagree with the late payment penalty you can forward an appeal in writing to the Collection Unit of LHDN within 30 days of being issued a Notice of Increased Assessment.

. In the lhdn form there is one sentence mentioning hadiah. Benefit in kind BIK leave passage driver motor vehicle etc. LHDN has deferred the remittance of WHT until 31032022.

Race and religion is a drawcard for some ignorant people but its off-putting for many who seek a different kind of Malaysia. Same as above tax exempt as long as the amount is not unreasonable and is. For the EPF funds distribution I checked my own EPF statement based on my i-Saraan contribution EPF automatically allocates 70 of my contribution to Account 1 and the balance of 30 to account 2.

112019 12122019 - Refer Year 2019. This benefit is treated as income of the employees. Examples of Benefit in Kind include company car driver and house rent.

And i google T20 household income RM15k -Speaking of such i fall into this category. The most common type of Benefit In Kind are. Basic NPL overtime shift additional pay bonuses etc 2.

Claiming capital allowance is an immediate tax cash. Monthly Forms Monthly Payroll Compliance Forms Annual Forms. If 2 No is entered immediately contact the LHDN branch in charge of the employees income tax file.

3 epf relief 10-15k. Types of taxable payroll items supported by QUICK PAY are. TP2 form is used to include these benefits as a part of an employees monthly earnings in order to determine the PCB amount that they are subjected to.

LHDN RPGT amendment under Budget 2022. Living Accommodation Benefit Provided for the Employee by the Employer Refer year 2009 for addendum. As of the assessment year of 2021 in this category you can claim for the purchase of.

In order to fully utilize tax and operational opportunities available businesses should conduct a cost and benefit analysis. SQL Payroll software is ready to use with minimal setup for all companies. 1 make reporting tax evaders simple.

Electronic submission e-Payment ready. Up to RM2500 for self spouse or child. Laptops personal computers smartphones or.

Only B40 reap the benefit. However the penalty imposed has to be settled first regardless of any appeal if you are successful LHDN will refund you the relevant amount at a later date. PCB is deducted from the employees taxable income only.

As per the Budget 2022 announcement individuals who are Malaysian citizens and permanent residents will benefit from the removal of the Real Property Gains Tax RPGT on the disposal of any residential property in the sixth year of ownership and beyond. What kind of pakar ekonomi is this This post has been edited by delon85. Gift of money or contribution in kind for the provision of facilities in public places for the benefit of disabled persons Gift of money or medical equipment to any healthcare facility approved by the Ministry of Health limited to RM20000 RM20000.

Reported to LHDN if A5 is applicable This item has to be completed if item A5 is applicable. To increase gov income 2 reduce income tax all brackets 1-2. Payments can be made at LHDNEPFSOCSO counters bank or post office or through online banking.

These external items fall into the category of Benefit in Kind. Provided to the employee on a regular basis and. Increment and Reduction in income tax.

The income tax calculator function that generates the PCB values requires the details of income paid in the payslip as well as income and benefits not paid together with the payslip. It is important to note that a person driving a company vehicle is subjected to Benefit In Kind. While East Malaysians have kept their racial and religious harmony intact despite Umnos presence in Sabah Peninsular Malaysia politicians are still splitting the people and turning one against the other.

Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. Thank you for your comment as well. Hence all the tax exemption on allowances benefit-in-kind and perquisites must be excluded in this case.

Gift of paintings to the National Art Gallery or any state art gallery. Whoever put gst into manifesto deserves to lose. Benefit In Kind is a non-cash allowance.

I have 2 children living in less than 600k house drive honda Both hsuband and wife and we dont buy luxury branded goods no. Kakitangan has provided a real solution for our organisation. LHDN Capital Allowance CP204 CP500 Real Property Gains Tax.

Perquisite semi-tax payroll items 3. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. LHDN EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready.

Superceded by the Public Ruling No. A review on 3 types of allowances with reference from LHDN Tax Ruling including the newest listing of tax incentive tax deduction for company in Malaysia. Prepare a handphone line Ambil gambar whatsapp dekat lhdn for them to check.

QUICK PAY complies with LHDN latest PCB computation and is capable of calculating employee monthly tax accurately. SQL Payroll software is ready to use with minimal setup for all companies. Electronic submission e.

The living accommodation is a benefit-in-kind that is not convertible into money. LHDN EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready. Thank you for your kind words it means a lot to me.

How to calculate RPGT and what kind of impact does. Provided to all employees at the same rate. A 2 Withholding Tax WHT will be imposed to agents dealers or distributors whose commission exceed RM100k within 1 year.

Enter 1 Yes if the employer has reported the cessation to LHDN. Sep 30 2022 0901 AM. BUT i do not live luxury having luxury lifestyle own fancy car own fancy houses.

I saw many people complaining T20 earn a lot. 4 increase relief for children below 18 5 no gst. The following annual forms are required.

As our team grows having a one-stop platform is absolutely wonderful. Computation of Income Tax Payable by a Resident. Increment and Reduction in income tax.

BIK Malaysia stand for Benefit in kind is a tax benefit provided by the employer in non cash how to calculate the value of Malaysia benefit in kind BIK. Also known as lifestyle tax relief in Malaysia this is the single persons favourite category under the topic of Personal Tax Reliefs. This includes payment by the employer directly to the parking operator.

Cars accommodation chauffeurs are a few examples of benefit in kind. Benefits in kind are non-monetary benefits that are given to an employee during their period of service in the company. M40 kering kontang T20 probably still enjoying their life or migrate.

Perquisites From Employment. As long the amount is not unreasonable this benefit is also tax exempt. A2Z2U WooTz and 7 others liked this post.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

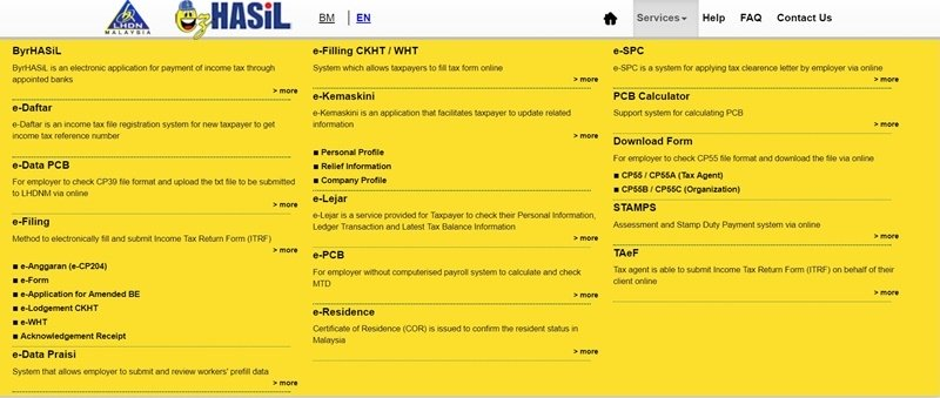

Lhdn E Filing Your Way Through Tax Season Properly

Perquisites From Employment Lembaga Hasil Dalam Negeri

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Ctos Lhdn E Filing Guide For Clueless Employees

Blog Real Property Gain Tax Penalty Thk Management Advisory Sdn Bhd

Personal Tax Relief For 2022 Smart Investor Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Amazon Com Bovine Colostrum Capsules With Immunoglobulin G Colostrum Supplement And Muscle Builder For Gut Health Joint Support Immune Boost Bone Strength And Brain Support Probiotic Supplement Health Household

What You Need To Know About Income Tax Ccng Chartered Accountants

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Vienna Advantage Payroll Solution Gets Certified By The Inland Revenue Board Of Malaysia Lhdnm Vienna Advantage

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Edgar Filing Documents For 0001640334 22 001282

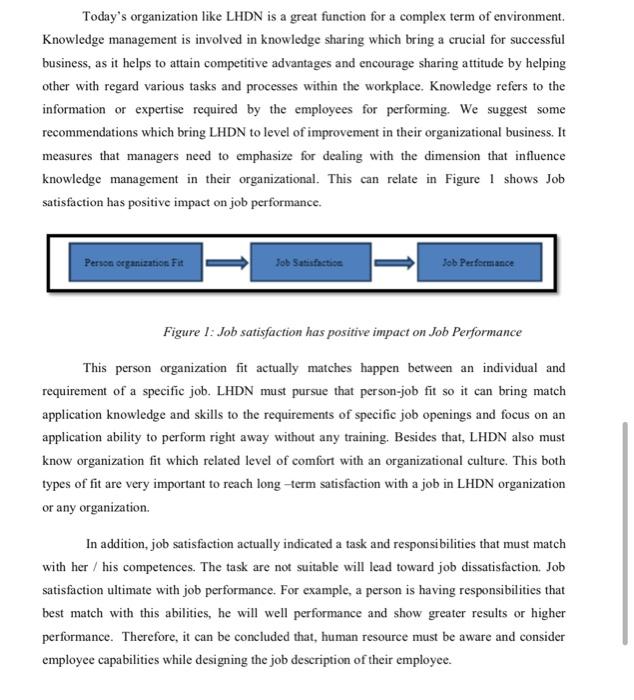

Solved Subject Knowledge Managementin Real Working Chegg Com

Quick Guide To Tax Deductions For Donations Gifts

0 Response to "benefit in kind lhdn"

Post a Comment